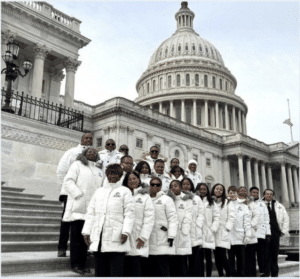

Eight Santa Maria High School students in the Close Up Washington D.C. Club traveled to the nation’s capitol with teacher and club co-advisor Amy Hennings March 2-7 to participate in the Close Up Civics Program.

Eight Santa Maria High School students in the Close Up Washington D.C. Club traveled to the nation’s capitol with teacher and club co-advisor Amy Hennings March 2-7 to participate in the Close Up Civics Program.

Eight Santa Maria High School students in the Close Up Washington D.C. Club traveled to the nation’s capitol with teacher and club co-advisor Amy Hennings March 2-7 to participate in the Close Up Civics Program.

Eight Santa Maria High School students in the Close Up Washington D.C. Club traveled to the nation’s capitol with teacher and club co-advisor Amy Hennings March 2-7 to participate in the Close Up Civics Program.

On March 3, the Senate confirmed Linda McMahon as the thirteenth secretary of education.1 Secretary McMahon has pledged to dismantle the Department of Education in what she calls its “final mission,” and on March 11, the Department announced it was cutting nearly 50 percent of its workforce.2 President Donald Trump is expected to sign an executive order directing Secretary McMahon to “take all necessary steps to facilitate the closure of the Education Department,” though the Department cannot be abolished unilaterally by the executive branch; this would require an act of Congress.3

On March 3, the Senate confirmed Linda McMahon as the thirteenth secretary of education.1 Secretary McMahon has pledged to dismantle the Department of Education in what she calls its “final mission,” and on March 11, the Department announced it was cutting nearly 50 percent of its workforce.2 President Donald Trump is expected to sign an executive order directing Secretary McMahon to “take all necessary steps to facilitate the closure of the Education Department,” though the Department cannot be abolished unilaterally by the executive branch; this would require an act of Congress.3

What Is the Department of Education?

The Department of Education that we have today was created by Congress in 1979 as a cabinet-level department within the executive branch of the federal government.4 It consolidated resources, staff, and programs across other executive departments and agencies into one centralized place in an effort to advance its goals of student success and opportunity in education.5 It is the smallest of the 15 cabinet departments, with approximately 4,200 employees.6 However, its budget is the third largest, after the Department of Defense and the Department of Health and Human Services.7

While the Department of Education is relatively modern and education in the United States is primarily a responsibility of state and local governments, the federal government has played a significant role in education policy since the 1860s. After the Civil War, it began collecting data and offering grants to aid states in creating schools, training teachers, and covering the cost of tuition for students.8 It funded school districts and provided loans for higher education during the post-World War II education boom and Cold War-era focus on the fields of science, technology, engineering, and mathematics.9 And during the civil rights era, it enforced equal protections in schools for students and teachers regardless of their race, color, national origin, sex, religion, age, or disability.10

In 2020-2021, approximately 11 percent of elementary and secondary public school funding was from federal sources, 46 percent was from state sources, and 44 percent was from local sources. With an annual budget of $268 billion, the Department of Education still primarily focuses on funding and research. It administers grants for schools and students, issues loans to students, collects and publishes data, recommends best practices, and ultimately ensures equal access to education for students across the country.11 Sixty percent of its funding goes directly to financial aid programs to help low-income students afford higher education.12 The Department of Education does not establish schools, set education standards, set graduation requirements, or create curricula.13

Why Is the Trump Administration Trying to Abolish the Department of Education?

There have been longstanding calls from the Republican Party to abolish the Department of Education. Mere months after the Department was created, the 1980 Republican platform stated that the party “supports deregulation by the federal government of public education, and encourages the elimination of the federal Department of Education.”14 Republican presidents since Ronald Reagan have called for the federal government to be scaled back in size and scope, preferring issues such as education to be left solely to the states. Despite this, when put to Congress, efforts to abolish the Department of Education have been soundly defeated across party lines in both the House of Representatives and the Senate.15

Secretary McMahon argues that the country does not need the Department of Education, and President Trump has routinely criticized it as unnecessary, wasteful, and ideologically compromised.16 In President Trump’s first term, his secretary of education took steps to curtail the work of the Department by shrinking the size of its workforce, reducing its budget, scaling back nondiscrimination protections, and rescinding guidance tied to the use of federal funds.17 In the first weeks of his second term, President Trump signed an executive order to deny funding for schools that he claims promote “radical, anti-American ideologies” that “deliberately [block] parental oversight.”18 And last month, the Department of Government Efficiency cut over $900 million in research contracts from the Department.19

What Do Supporters and Opponents Say?

President Trump’s criticisms of the Department of Education reflect the larger views of those who also support its abolition and are distrustful of the federal government, especially in the wake of the COVID-19 lockdowns, mask mandates, and the prevalence of diversity, equity, and inclusion initiatives.20 These supporters advocate for more power to states, school boards, and especially parents to make educational choices for their students, rather than relying on a bureaucracy in Washington. They advocate for school choice programs and funding for private schools, along with parental review of school curricula and book bans on local and state levels. Additionally, they cite the Department’s large budget and stagnant student test scores as further proof that it is ineffective at achieving its goals.21

Those who oppose abolishing the Department of Education reiterate that it is not involved in setting school standards or creating curricula. Instead, they underscore the importance of the Department’s role in providing funds and enforcing antidiscrimination laws. Pell Grants administered by the Department support one-third of low-income college students, and half of all undergraduates in the United States rely on some form of federal financial aid.22 Antidiscrimination laws make sure students have equal access and opportunity to succeed without burden or bias. With inequities growing between wealthier and poorer school districts and students, they see the Department of Education as vital, especially as students continue to struggle academically in the wake of the pandemic.23

Discussion Questions

Related Posts

As always, we encourage you to join the discussion with your comments or questions below.

Close Up is proud to be the nation’s leading nonprofit civic education organization, working with schools and districts across the country since 1971. If you would like to partner with us or learn more about our experiential learning programs, professional development, or curriculum design and consulting, contact us today!

Sources

On February 25, President Donald Trump announced that new tariffs on goods from Canada and Mexico would go into effect on March 4.1 President Trump revived the use of tariffs in 2018, ending seven decades of emphasis on free trade economic policies. Since 2018, both Presidents Trump and Joe Biden have enacted several major tariffs, significantly impacting worldwide trade.2

On February 25, President Donald Trump announced that new tariffs on goods from Canada and Mexico would go into effect on March 4.1 President Trump revived the use of tariffs in 2018, ending seven decades of emphasis on free trade economic policies. Since 2018, both Presidents Trump and Joe Biden have enacted several major tariffs, significantly impacting worldwide trade.2

Tradeoffs of Free Trade

Tariffs were historically used to protect domestic businesses from imports (goods bought from other countries). Once common in overseas trade, tariffs began disappearing after World War II in favor of free trade agreements. Removing tariffs allowed Americans to buy imports at low prices.3 Imported products that were cheap to make and easy to ship quickly replaced more expensive American-made goods.4 Although consumers benefited from low prices, American manufacturers couldn’t keep up. Communities across the country suffered as local factories closed and residents lost their jobs.5

One way foreign countries keep costs down is by tolerating poor working conditions and low pay. To cut prices even more, some foreign governments also spend taxpayer dollars supporting major industries, sometimes spending less on education or infrastructure.6 The difference in business costs can be staggering. For example, American minimum wage laws require businesses to pay employees anywhere from three to ten times more than what must be paid to workers in China.7 Consequently, many American companies moved their factories overseas to lower manufacturing costs and pass those savings to their customers.

How Do Americans Feel About Tariffs?

Groups that have supported recent tariffs include labor unions, human rights activists, and communities hurt by free trade. Supporters argue that tariffs help American businesses compete with cheaper imports made with unfair or inhumane business practices.8 Additionally, President Trump has declared that the U.S. trade deficit threatens the economy. A trade deficit occurs when a country imports more goods than it sells to foreign buyers. In 2016, the year before President Trump took office for the first time, the trade deficit was $481 billion.9 Furthermore, leaders in both political parties have supported tariffs; not only did President Biden continue many Trump-era tariffs but he enacted additional tariffs targeting China.10

National security experts also caution that imports are a serious threat to government secrets and intellectual property. Some imported goods have compromised sensitive data with hidden programming, and importing critical resources like energy or steel puts the United States in a vulnerable economic position.11 Tariffs can help American industries capture consumer spending, allowing them to grow. A strong manufacturing sector protects the economy from global shortages.

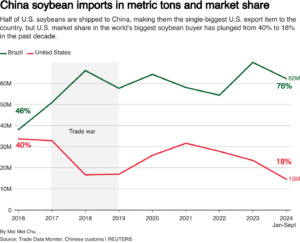

In contrast, most economists argue that tariffs harm Americans.12 Businesses simply raise prices on imported goods, leaving consumers without cheaper alternatives. Americans buy less, and the economy slows. Furthermore, countries have retaliated by enacting their own tariffs on American goods. For example, after tariffs went into effect in 2018, Chinese officials targeted Midwest farmers by implementing high tariffs on American soybeans and shifted soybean trade to Brazil. In the years since, American farmers have needed billions of dollars in federal aid to recover from the loss in revenue.13 Opponents also point out that tariffs did nothing to balance trade, as America’s trade deficit has more than doubled in the last seven years.14 Currently, economists predict that the new 2025 tariff proposals will increase inflation; consumers will pay more, and businesses will suffer.15

In contrast, most economists argue that tariffs harm Americans.12 Businesses simply raise prices on imported goods, leaving consumers without cheaper alternatives. Americans buy less, and the economy slows. Furthermore, countries have retaliated by enacting their own tariffs on American goods. For example, after tariffs went into effect in 2018, Chinese officials targeted Midwest farmers by implementing high tariffs on American soybeans and shifted soybean trade to Brazil. In the years since, American farmers have needed billions of dollars in federal aid to recover from the loss in revenue.13 Opponents also point out that tariffs did nothing to balance trade, as America’s trade deficit has more than doubled in the last seven years.14 Currently, economists predict that the new 2025 tariff proposals will increase inflation; consumers will pay more, and businesses will suffer.15

Support for tariffs among some groups of Americans has grown, especially among Republicans and independents living in areas where decades of free trade devastated the local economy. However, research indicates that tariffs have hurt Americans’ wallets and cost over 170,000 jobs over the last seven years.16 If tariffs are harming the economy, why hasn’t support declined? Polling indicates that opinions on tariffs, just as on other issues, are based on a combination of values, not just data points or dollars—an important consideration in policy discussions.

Discussion Questions

As always, we encourage you to join the discussion with your comments or questions below.

Close Up is proud to be the nation’s leading nonprofit civic education organization, working with schools and districts across the country since 1971. If you would like to partner with us or learn more about our experiential learning programs, professional development, or curriculum design and consulting, contact us today!

Sources

“The United States should do whatever it can to assist in the return of normal economic health in the world, without which there can be no political stability and no assured peace. –Secretary of State George C. Marshall1

A Marshall Plan for Tribal Nations has gained support as tribal leaders and advocates call on the United States to fulfill its longstanding trust and treaty obligations.3 The phrase invokes the European Recovery Program—commonly known as the Marshall Plan—which the United States implemented after World War II to rebuild war-torn Europe. Today, Indigenous leaders are advocating for a similarly ambitious investment to repair the harm caused by centuries of policies that have left tribal nations underfunded and deprioritized.3

A Marshall Plan for Tribal Nations has gained support as tribal leaders and advocates call on the United States to fulfill its longstanding trust and treaty obligations.3 The phrase invokes the European Recovery Program—commonly known as the Marshall Plan—which the United States implemented after World War II to rebuild war-torn Europe. Today, Indigenous leaders are advocating for a similarly ambitious investment to repair the harm caused by centuries of policies that have left tribal nations underfunded and deprioritized.3

The United South and Eastern Tribes Sovereignty Protection Fund (USET SPF) spearheads advocacy for this proposal. This blog post reflects the perspectives and language of the Marshall Plan for Tribal Nations: A Restorative Justice and Domestic Investment Plan published by USET SPF. It provides an overview of the proposed plan and includes discussion questions and further resources to help educators explore this issue with students.

Historical Context: Tribal Nations and the United States

Tribal nations have long been categorized as sovereign political entities, as reaffirmed by the U.S. Constitution,4 treaties, federal statutes, and Supreme Court decisions.5 Despite this legal political status, the United States has continuously failed to fulfill its trust and treaty obligations. This negligence has led to widespread disparities in infrastructure, education, health care, and economic opportunity within tribal communities.

The federal government has acted to terminate, assimilate, and destabilize tribal nations through forced removal, violence, broken treaties, and systematic underfunding. Even in the modern era, federal appropriations for tribal nations have fallen short of what is necessary to meet basic needs.6 This has led to significant gaps in services and infrastructure that are commonplace in other communities.

What Is the Marshall Plan for Tribal Nations?

“What we are talking about is not an ask for handouts. This is about the United States living up to the promises that it made to Tribal Nations—promises that were made in exchange for our land and resources.” –Kitcki Carroll (Cheyenne and Arapaho Tribes of Oklahoma), Executive Director of USET and USET SPF

The Marshall Plan for Tribal Nations is a proposal to rectify the historical injustices and ongoing neglect of trust and treaty obligations through a significant investment that acknowledges and begins to address the United States’ debt to Indigenous peoples. Key components of the plan include:

Comparing the European and Tribal Nations Marshall Plans

The original Marshall Plan allocated approximately 1-2 percent of U.S. gross domestic product (GDP) to rebuild European nations, providing over $13 billion (equivalent to nearly $135 billion today) for a four-year program.7 By contrast, the United States has historically underfunded tribal nations, with appropriations amounting to just 0.07 percent of the value of land taken from Indigenous peoples. If the United States were to invest at a level comparable to the European Marshall Plan, this would translate to hundreds of billions of dollars dedicated to rebuilding tribal nations.

Why This Matters

Understanding the Marshall Plan for Tribal Nations allows students to engage with key civics concepts, including federal treaty obligations and trust responsibilities, tribal sovereignty, and the long-term impacts of federal Indian policy. This allows students to critically analyze how policy decisions shape tribal self-governance and explore restorative justice in U.S.-tribal nation relations.

Discussion Questions

Other Resources

As always, we encourage you to join the discussion with your comments or questions below.

Close Up is proud to be the nation’s leading nonprofit civic education organization, working with schools and districts across the country since 1971. If you would like to partner with us or learn more about our experiential learning programs, professional development, or curriculum design and consulting, contact us today!

Sources

On January 20, his first day back in office, President Donald Trump issued an executive order that stops new offshore wind projects from obtaining lease permits, halting development meant to power over 12 million homes.1 At a rally later that day, President Trump characterized wind turbines as ugly and harmful to property values and to the environment.2

On January 20, his first day back in office, President Donald Trump issued an executive order that stops new offshore wind projects from obtaining lease permits, halting development meant to power over 12 million homes.1 At a rally later that day, President Trump characterized wind turbines as ugly and harmful to property values and to the environment.2

What is Offshore Wind?

Wind farms generate energy from natural winds that spin the blades of large wind turbines. Wind turbines offer a renewable alternative to the burning of fossil fuels such as oil and natural gas. Renewable energy (energy from Earth’s natural forces), unlike energy from burning fossil fuels, does not emit the greenhouse gases that are increasing global temperatures. Climate scientists and activists argue that replacing fossil fuels with renewable energy sources is necessary to limit climate change and future devastating effects on Earth.3 Wind farms built offshore, in the ocean or other large bodies of water, harness large amounts of wind energy from unobstructed coasts.

There are two main types of offshore wind turbines: floating turbines and fixed-bottom turbines. They differ in how they are attached to the ocean floor. Cables secure floating turbines, while fixed-bottom turbines are built directly on the ocean floor. Fixed-bottom turbines are the most common—they are easier and cheaper to install—but they can only be built in shallow water.4 The United States has an estimated 1.5 terawatts (equal to 1,500 gigawatts) of fixed-bottom offshore wind potential—enough energy to power the entire country.5

Currently, there are only three fully operational offshore wind farms in the United States. The 132-megawatt South Fork Wind Farm is the newest offshore wind farm and operates off the coast of Long Island, New York. Completed in December 2023, this project was the first commercial-scale wind farm in the country.6 Generating more offshore wind infrastructure could significantly decrease American dependence on fossil fuels and reduce energy costs, but new projects require a large amount of money to fund construction as well as approval and guidance from multiple government agencies. Elected officials now must decide: should the government support more offshore wind projects?

The Debate Over Offshore Wind

Supporters of offshore wind note that one of its major benefits is its capacity to generate large amounts of energy, compared to less efficient forms of renewable energy like onshore wind farms. Because wind is stronger and more consistent over bodies of water, offshore turbines can generate twice as much energy as those on land.7 Offshore wind farms are typically built several miles off the coast and are minimally visible from shore. Additionally, coasts have fewer obstructions and building limitations, a problem that wind farms on land commonly face. Furthermore, investment in offshore wind creates jobs and economic growth in local communities because workers are needed to maintain turbines and connect wind farms to the rest of the electric grid. Finally, higher offshore wind capacity can contribute to greater energy independence by increasing the amount of energy produced in the United States and thereby reducing America’s reliance on foreign sources of energy.8

Opponents, however, believe the benefits of offshore wind are outweighed by costs and environmental disruption.9 For offshore wind to be viable, policy leaders must grant developers more money and change regulations at all levels of government. The approval process can take years of negotiating with communities, government agencies, and other industries, such as the fishing industry, which can lead to costly delays. Additionally, constructing offshore turbines, especially drilling for fixed-bottom models, threatens vulnerable ecosystems.10 Finally, coastal communities frequently oppose any changes to treasured shoreline views. For example, the Vineyard Wind project off the coast of Martha’s Vineyard, Massachusetts, faced significant opposition from residents who were concerned about turbines interrupting the natural coastline view surrounding the island.12

Many policymakers and voters agree on a need to transition away from fossil fuels, but the federal government has yet to develop a unified set of policy actions. Offshore wind offers an opportunity to generate large amounts of renewable energy, but Americans must decide if its potential is worth the significant advocacy and investment it requires.

Discussion Questions

As always, we encourage you to join the discussion with your comments or questions below.

Close Up is proud to be the nation’s leading nonprofit civic education organization, working with schools and districts across the country since 1971. If you would like to partner with us or learn more about our experiential learning programs, professional development, or curriculum design and consulting, contact us today!

Sources

On his first day back in office, President Donald Trump signed an executive order that implemented a 90-day freeze on aid to other countries. Since then, the offices of the U.S. Agency for International Development (USAID) have closed, staff have been furloughed, and there have been more funding freezes. The formerly semi-autonomous agency is now under the leadership of Secretary of State Marco Rubio. Tech billionaire Elon Musk, who leads the new advisory body called the Department of Government Efficiency (DOGE), has targeted USAID and foreign aid when advocating for cutting the federal budget.

On his first day back in office, President Donald Trump signed an executive order that implemented a 90-day freeze on aid to other countries. Since then, the offices of the U.S. Agency for International Development (USAID) have closed, staff have been furloughed, and there have been more funding freezes. The formerly semi-autonomous agency is now under the leadership of Secretary of State Marco Rubio. Tech billionaire Elon Musk, who leads the new advisory body called the Department of Government Efficiency (DOGE), has targeted USAID and foreign aid when advocating for cutting the federal budget.

What is USAID?

USAID was founded by an act of Congress in 1961, when President John F. Kennedy wanted a more efficient way to expand U.S. influence in the developing world by providing money and other forms of assistance. This was during the Cold War when the United States was competing with the Soviet Union for power and influence across the globe. The Foreign Affairs Reform and Restructuring Act, passed in 1998, established USAID as its own agency and largely separated it from the State Department. It is an agency within the State Department, which manages the United States’ relations with other countries, including our embassies abroad.

USAID funds an array of humanitarian projects around the world, including those related to providing clean water, infrastructure, and health care. The State Department provides broad foreign policy goals to USAID, but the agency decides on the specific projects to achieve those goals. Generally, independent private contracting companies bid on the projects that USAID funds.

Congress appropriated $66.1 billion for foreign aid in fiscal year 2023. That works out to 1.2 percent of that year’s total federal expenditure, which was more than $6.1 trillion. USAID administers around 60 percent of foreign aid.

Why Does the United States Provide Assistance to Other Countries?

There are many reasons countries provide foreign aid to other nations beyond simply helping people living in poverty or conflict.

Why Has President Trump Decided to Cut Funding to USAID?

President Trump and Musk argue that USAID is full of fraud and waste. President Trump has also said that the projects that USAID funds are not in line with current U.S. foreign policy goals, and that the agency is being run by “radical lunatics.” On February 3, the White House published a list of USAID projects that it said were evidence of waste and abuse, including $1.5 million to “advance diversity, equity, and inclusion in Serbia’s workplaces and business communities”; $70,000 for a production of a “DEI musical” in Ireland; $2.5 million for electric vehicles for Vietnam; and millions of dollars to the EcoHealth Alliance, a U.S.-based nongovernmental organization which was allegedly involved in research at the Wuhan Institute of Virology.

Musk has made unsubstantiated claims about USAID’s role in the COVID-19 pandemic, and that it is a criminal organization led by the far left. The executive order that President Trump signed said that foreign aid “serves to destabilize world peace by promoting ideas in foreign countries that are directly inverse to harmonious and stable relations internal to and among countries.”

Secretary Rubio has argued that USAID has lost its focus and abandoned the “national interest,” citing complaints from U.S. officials and foreign leaders. “They have basically evolved into an agency that believes that they’re not even a U.S. government agency, that they are out—they’re a global charity, that they take the taxpayer money, and they spend it as a global charity irrespective of whether it is in the national interest or not in the national interest,” said Secretary Rubio. “One of the most common complaints you will get if you go to embassies around the world from State Department officials and ambassadors and the like is USAID is not only not cooperative—they undermine the work that we’re doing in that country, they are supporting programs that upset the host government for whom we’re trying to work with on a broader scale, and so forth.”

What Has the Response Been?

Republicans, who have typically pushed to give the State Department more control of its policy and funds, have been largely supportive of scrutinizing USAID spending. “I think the administration has every right to demand accountability and transparency in all these programs,” said Senate Majority Whip John Barrasso (R-Wyo.).

Democrats, who have typically promoted USAID autonomy and authority, say that USAID has been authorized by Congress, so President Trump cannot legally dissolve it or allow the State Department to take over. USAID workers and contracting companies have sued, saying Congress decides how the country spends money, so they say the president cannot legally refuse to spend money that Congress has directed the government to spend. Additionally, USAID workers stationed in the Democratic Republic of the Congo are suing the administration for money they spent when they were forced to evacuate and the agency had already stopped paying for employee travel.

Farmers are also concerned about funding cuts. American farms supply about 41 percent of the food aid distributed by USAID. Food worth $340 million, including rice, wheat, and soybeans, is left stranded in the United States.

Discussion Questions

More Resources

As always, we encourage you to join the discussion with your comments or questions below.

Close Up is proud to be the nation’s leading nonprofit civic education organization, working with schools and districts across the country since 1971. If you would like to partner with us or learn more about our experiential learning programs, professional development, or curriculum design and consulting, contact us today!

Sources

During his first administration, President Donald Trump made tariffs and trade a major part of his economic policy. As he campaigned for another term, he further emphasized how he would use tariffs and trade if reelected. His strategy of issuing tariffs would be used to create more manufacturing jobs for Americans, shrink both the federal deficit and the U.S. trade deficit, and lower food prices.1 During the campaign, then-Vice President Kamala Harris pushed back, saying that Trump’s strategy would have a negative impact on families and their income. She saw, for example, a 20 percent universal tariff by a Trump administration costing families nearly $4,000 per year.2 This debate came at a time when inflation and the cost of consumer goods were among the top issues on voters’ minds.

During his first administration, President Donald Trump made tariffs and trade a major part of his economic policy. As he campaigned for another term, he further emphasized how he would use tariffs and trade if reelected. His strategy of issuing tariffs would be used to create more manufacturing jobs for Americans, shrink both the federal deficit and the U.S. trade deficit, and lower food prices.1 During the campaign, then-Vice President Kamala Harris pushed back, saying that Trump’s strategy would have a negative impact on families and their income. She saw, for example, a 20 percent universal tariff by a Trump administration costing families nearly $4,000 per year.2 This debate came at a time when inflation and the cost of consumer goods were among the top issues on voters’ minds.

What Are Tariffs?

Tariffs are charged as a percentage of the price a buyer pays a foreign seller for a product or commodities. Tariffs are intended to protect and boost domestic industries and home-grown manufacturers when the price of imports increase. Or, they can be used to punish foreign countries for committing unfair trade practices.3

So, why does President Trump advocate for tariffs today? He has cited several reasons, including generating revenue for the United States; influencing the policies of, and wielding power over, rival countries; and evening out the balance between U.S. imports and exports. Earlier this year, the Commerce Department reported that the U.S. goods trade deficit in 2024 had reached a record $1.2 trillion. In other words, the United States imported $1.2 trillion more in goods than it exported. The report also showed that the United States ran record bilateral trade deficits with Mexico, Vietnam, India, Taiwan, South Korea, and the European Union (EU).

According to White House Senior Counselor for Trade and Manufacturing Peter Navarro, a central goal of President Trump’s trade policy is to reduce the trade deficit “to zero.” This month, Navarro blamed high levels of imports for millions of lost American jobs, thousands of factory closings, and social and health problems such as alcoholism and drug addiction.4

A Study on the Impact of Tariffs

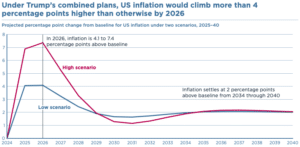

Last year, a study by the Peterson Institute for International Economics (PIIE) examined the impact of now-President Trump’s proposed tariffs.5 The major takeaways: lower national income, lower employment, and higher inflation. According to the study, the manufacturing and agriculture sectors would be most impacted.

Per PIIE: “We have no partisan goal in publishing this research. Our concerns are about the policies, not the candidate. Our objective is to educate policymakers and the public about the effects these measures would have on the U.S. and other economies.”6

PIIE predicted a 10 percent policy on all U.S. tariffs would increase inflation by 1.3 percent, and a 60 percent policy on imports from China would increase inflation by 0.7 percent.7

The Historical Context of Tariffs

From 1790 to 1860, approximately 90 percent of federal revenue came from tariffs.8 A federal income tax was created in 1913 to help generate revenue, and in 1945 the dependency on and use of tariffs decreased due to the need for larger revenue streams that tariffs alone couldn’t provide.9 The Trade Act of 1974 changed how presidents approached trade and tariffs with other countries for over 40 years, until President Trump.10 The law preauthorized removal of trade barriers on a reciprocal basis in negotiations with foreign countries, later renewed by subsequent administrations. Freer trade became a key part of Republican Party platforms for presidential candidates throughout this time period.

The State of Tariffs Today

In 2018, President Trump issued tariffs on steel and aluminum that caused the European Union to put tariffs on American whiskey, leading to exports of whiskey falling by 30 percent after a 25 percent tariff was issued.11 Those tariffs are set to expire in 2025. President Trump’s tariffs on China led to soybean exports dropping by 75 percent.12 He has proposed using tariffs on farm imports to lower the cost of food products, but some economists feel this would increase grocery prices and reduce consumer choice.13 These economists warn that foreign producers can pass along some or all of the tax burden on consumers in the form of higher prices.14 When the last fiscal year ended on September 30, tariffs and fees generated roughly one-third of the revenue of income taxes and roughly half of the revenue of Social Security and Medicare taxes.15

Now in the early days of his second term, President Trump has carried out his promise of 25 percent tariffs on goods from Canada and Mexico and 10 percent on goods from China. The Canada and Mexico tariffs have been paused for 30 days. The tariffs from China could impact over $450 billion worth of imports, and the Tax Foundation estimates they could add a $172 tax burden per household.16 China has responded with 15 percent tariffs on coal, natural gas, crude oil, and farm equipment. Tariffs on Canada and Mexico would impact produce such as tomatoes, strawberries, and avocados, as well as car and gas prices and construction materials like lumber.17 PIIE predicts that the combined tariffs would cost the median household over $1,200 a year.18 President Trump has also issued a 25 percent tariff on all steel and aluminum imports, which would impact Canada and Mexico the most.

Discussion Questions

As always, we encourage you to join the discussion with your comments or questions below.

Close Up is proud to be the nation’s leading nonprofit civic education organization, working with schools and districts across the country since 1971. If you would like to partner with us or learn more about our experiential learning programs, professional development, or curriculum design and consulting, contact us today!

Sources

TOWNSEND — Superintendent Brad Morgan and Principal Laurie Smith are pleased to announce that North Middlesex Regional High School senior Adam Manni has been selected to participate in the Close Up Washington: Johnson & Johnson Scholarship Program.

TOWNSEND — Superintendent Brad Morgan and Principal Laurie Smith are pleased to announce that North Middlesex Regional High School senior Adam Manni has been selected to participate in the Close Up Washington: Johnson & Johnson Scholarship Program.

Washington, D.C. was the spot, as 32 students and three teachers from McIntosh High got hands-on for a week of sightseeing and civic engagement workshops through the “Close Up Foundation.”

Washington, D.C. was the spot, as 32 students and three teachers from McIntosh High got hands-on for a week of sightseeing and civic engagement workshops through the “Close Up Foundation.”

In January 2025, twelve students from Northwest Indiana had the unique opportunity to participate in a weeklong government studies program in Washington D.C. through the ECIER Foundation. This unforgettable trip was part of a partnership with the Close Up Foundation, which is dedicated to providing high school students with an in-depth, hands-on learning experience about the U.S. government. The students, representing several schools in the region, were able to engage with peers from across the country and witness firsthand the workings of American democracy.

In January 2025, twelve students from Northwest Indiana had the unique opportunity to participate in a weeklong government studies program in Washington D.C. through the ECIER Foundation. This unforgettable trip was part of a partnership with the Close Up Foundation, which is dedicated to providing high school students with an in-depth, hands-on learning experience about the U.S. government. The students, representing several schools in the region, were able to engage with peers from across the country and witness firsthand the workings of American democracy.