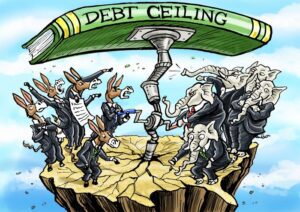

The Debt Ceiling Fight

May 19, 2023 by

Recently, the Republican-led House of Representatives has been at odds with the Democrat-led Senate and President Joe Biden over raising the national debt ceiling. This issue touches on one of the fundamental powers of Congress—setting the budget for the federal government. Disagreements over spending have led to the current divide between the Republican and Democratic Parties on the issue. If the debt ceiling is not raised, the government may be unable to pay its debts as early as June 1, which could have serious consequences for the economy.

What Is the National Debt Ceiling?

Most years, the amount spent by the federal government is greater than the amount of money it collects in taxes. This is called a deficit. The last time the federal government experienced a surplus (meaning it collected more money than it spent) was 2001.1 Federal spending accounts for a wide range of sectors and services, including Social Security, Medicare, and national defense. When there is a deficit, the government must borrow money in order to pay for such priorities and this adds to the national debt.

The debt ceiling is the maximum amount of total debt that the federal government is allowed to have, as determined by Congress. The debt ceiling is also a limit on the total debt that can be incurred to pay for the current budget and does not authorize any new spending beyond that.2

Currently, the total national debt of the United States (which includes all debt from previous years in addition to this year) is $31.46 trillion—that’s $31,460,000,000,000.3 To put that into context, at the time of this publication, Amazon founder Jeff Bezos is estimated to be worth $134 billion.4 The current debt held by the federal government is equivalent to over 234 times that.

Secretary of the Treasury Janet Yellen has informed Congress that in order for the United States to continue to pay for its spending beyond June 1, it will have to raise the debt limit higher than the current $31.46 trillion.5

What Happens If the Debt Ceiling Is Not Raised?

The federal government is expected to pay its debts just as any individual person would be. Much like any borrower, if interest on debt is not paid then that debt goes into default. When an individual goes into default, it has a negative effect on their credit and makes it harder for them to borrow money in the future because they are no longer considered a reliable borrower.

What happens when a country with an economy as large as the United States’ goes into default? The most direct answer is that no one can be sure because it has never happened before. But most economists believe it would cause enormous problems for the economy and could even trigger a global financial crisis.6 A default could see the U.S. economy shrink, Social Security benefits and government salaries go unpaid, stock prices drop, the loss of millions of jobs, even an economic recession. It could also result in foreign investors taking money out of the U.S. economy and make investors less likely to invest in the United States in the future.7

Why Hasn’t the Debt Ceiling Been Raised?

Historically, the debt ceiling has been raised 78 times since 1960.8 However, raising the debt ceiling requires a vote by both chambers of Congress. President Biden and the Democrat-controlled Senate are in favor of raising the debt ceiling to avoid a default. The Republican-controlled House is also interested in avoiding a default but so far has only been willing to raise the debt ceiling in exchange for future spending cuts. These cuts would include lowering future budget increases to a maximum of one percent per year, imposing stricter work requirements to receive SNAP (food stamp) benefits, reducing funding for the Internal Revenue Service, reclaiming any unspent COVID-19 relief funds, preventing President Biden’s proposed $10,000 student loan relief, repealing climate change provisions, and increasing oil and gas production.9 Thus far, President Biden has been unwilling to support any spending cuts.10

Discussion Questions

- Do you feel that the debt ceiling should be raised with or without spending cuts?

- Consider the sectors and services that account for federal government spending. Are there areas you feel that spending should be reduced? Are there areas you feel it should be increased?

- The national debt has grown at an increasing rate since the 1980s and that increase has accelerated significantly ever since 2001. Do you think it is important that the government reduce its overall spending or reduce deficits and the debt? What should be the government’s priorities in spending decisions?

- The debt ceiling has only existed since 1917 and some economists, including Secretary Yellen, have proposed eliminating it to avoid the risk of default. Do you think there should be limits on how much the government can spend? How might the federal government avoid these kinds of spending crises in the future?

Related Posts

As always, we encourage you to join the discussion with your comments or questions below.

Sources

Featured Image Credit: Jeb Hensarling/Wall Street Journal

[1] https://fiscaldata.treasury.gov/americas-finance-guide/national-deficit/

[2] https://www.cnbc.com/2023/05/09/debt-ceiling-explained.html

[3] https://fiscaldata.treasury.gov/americas-finance-guide/national-debt/#:~:text=Over%20the%20past%20100%20years,to%20%2430.93%20T%20in%202022.

[4] https://www.bloomberg.com/billionaires/profiles/jeffrey-p-bezos/

[5] https://www.nytimes.com/2023/05/02/business/economy/us-debt-ceiling.html

[6] Ibid.

[7] https://www.cfr.org/backgrounder/what-happens-when-us-hits-its-debt-ceiling

[8] https://www.cnbc.com/2023/05/09/debt-ceiling-explained.html#:~:text=The%20mechanism%20was%20created%20during,limit%2078%20times%20since%201960.

[9] https://www.cbsnews.com/news/debt-ceiling-house-republicans-bill-limit-save-grow-act/

[10] Ibid.